Old Tax Regime And New Tax Regime Explained In 3 Scenarios

New Delhi:

The Union Budget 2023-24, which was presented by Finance Minister Nirmala Sitharaman in Parliament on February 1, has brought significant changes to personal income tax. The income tax rebate limit has been increased to ₹ 7 lakh.

In Budget 2020, taxpayers were given an option to either continue with the old tax regime, where tax exemptions could be claimed, or opt for the new regime with lower tax rate but no exemptions. In both the old and new tax regimes, however, the annual income up to which one did not need to pay taxes was ₹ 5 lakh. This has been changed in the Union Budget 2023-24.

The Finance Minister, in her budget speech, proposed to increase the tax-free ceiling in the new tax regime to ₹ 7 lakh from the existing ₹ 5 lakh. This means that those who have chosen the new tax regime and have an income of up to ₹ 7 lakh will not be required to pay any taxes.

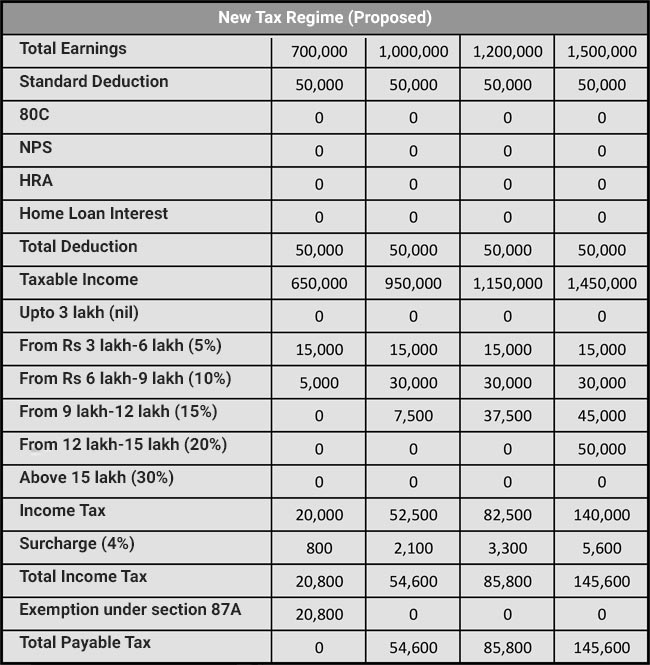

Besides this, the tax slabs have also been reworked and the number of slabs have been brought down from six to five. Now, in the new regime, income between ₹ 0-3 lakh will not be taxed. This is an increase of ₹ 50,000 from the zero to ₹ 2.5 lakh no-tax slab applicable earlier.

“I had introduced, in the year 2020, the new personal income tax regime with six income slabs starting from ₹ 2.5 lakh. I propose to change the tax structure in this regime by reducing the number of slabs to five and increasing the tax exemption limit to ₹ 3 lakh,” Ms Sitharaman said.

The new tax regime has also been made the default system for everyone. The old tax regime will be available on request, the finance minister announced.

Now if you are confused about which income tax regime will give you more tax savings, then let us break it down for you. The three scenarios below will help you choose the right regime.

Income with up to ₹ 7 lakh (Old tax regime)

If you have an income of up to ₹ 7 lakh in the old tax regime then your total taxable income after all deductions will turn out to be ₹ 3,70,000. The tax payable on it will be ₹ 6,240, which includes 4% surcharge and 5% tax in the ₹ 2.5 lakh to ₹ 5 lakh tax slab. This payable amount becomes zero after deductions under Section 87A of the Income Tax Act are claimed. Here, you can avail the various exemptions and deductions such as house rent allowance (HRA)and interest on home loan.

Income with up to ₹ 7 lakh (New tax regime)

If your annual income is up to ₹ 7 lakh then in the proposed new tax regime, you are not liable to pay any taxes on your income. However, you cannot claim any exemptions.

Income of ₹ 10 lakh (Old tax regime)

For those who have an annual income of ₹ 10 lakh, the taxable income will be ₹ 6 lakh after deductions of total ₹ 4 lakh. In this case, the income tax payable could be ₹ 33,800 after all exemptions and deductions.

Income of ₹ 10 lakh (New tax regime)

In the new tax regime, a person with ₹ 10 lakh annual income will have to pay ₹ 54,600 as income tax. The total taxable income here is ₹ 9,50,000, which is subject to tax at 5%, 10%, and 15%. No exemptions or deductions can be availed here.

Income of ₹ 15 lakh (Old tax regime)

Taxpayers with ₹ 15 lakh annual income will have to pay ₹ 1,06,600 as income tax. This includes 5% tax in the ₹ 2.5 – ₹ 5 lakh slab and 20% tax in the ₹ 5 – ₹ 10 lakh slab. Here, the total taxable income is ₹ 9,50,000.

Income of ₹ 15 lakh (New tax regime)

In the new tax regime, those with income of ₹ 15 lakh will have a taxable income of ₹ 14,50,000. This will be taxed at 5%, 10%, 15%, and 20% in different tax slabs, which brings the total tax payable to ₹ 1,45,000.

Social Plugin